Exploring Options: Can Former Bankrupts Secure Credit Rating Cards Complying With Discharge?

One usual inquiry that emerges is whether previous bankrupts can effectively acquire credit cards after their discharge. The solution to this questions entails a complex exploration of numerous elements, from credit report card choices tailored to this group to the influence of previous monetary decisions on future creditworthiness.

Understanding Charge Card Options

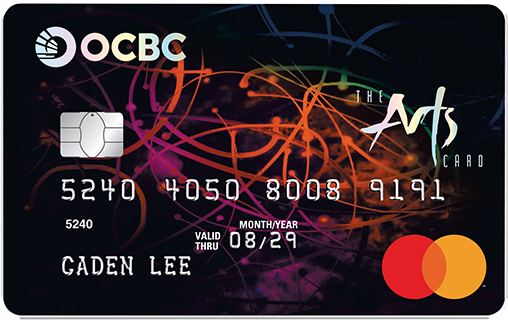

Navigating the realm of credit scores card options requires an eager understanding of the varying attributes and terms offered to customers. When taking into consideration bank card post-bankruptcy, people must thoroughly evaluate their needs and economic circumstance to select one of the most appropriate option - secured credit card singapore. Guaranteed charge card, as an example, need a cash money down payment as security, making them a viable choice for those aiming to rebuild their credit rating. On the various other hand, unprotected bank card do not necessitate a down payment but might come with higher rate of interest and charges.

In addition, people should pay close attention to the yearly percent price (APR), elegance period, annual fees, and benefits programs provided by various credit history cards. By comprehensively assessing these elements, individuals can make enlightened choices when picking a credit report card that lines up with their financial objectives and conditions.

Elements Affecting Approval

When using for credit scores cards post-bankruptcy, comprehending the elements that affect approval is necessary for people looking for to restore their economic standing. Adhering to a personal bankruptcy, credit ratings usually take a hit, making it more difficult to qualify for traditional debt cards. Showing liable monetary habits post-bankruptcy, such as paying bills on time and keeping credit scores usage low, can additionally favorably influence credit scores card approval.

Protected Vs. Unsecured Cards

Protected credit score cards require a cash money down payment as collateral, normally equivalent to the credit history restriction expanded by the issuer. These cards usually supply greater credit scores restrictions and lower interest rates for individuals with good credit score ratings. Eventually, the selection in between safeguarded and unsafe credit rating cards depends on the individual's financial situation and credit report objectives.

Building Credit Report Responsibly

To properly rebuild credit score post-bankruptcy, establishing a pattern of accountable credit report application is vital. One crucial means to do this is by making prompt payments on all credit score accounts. Settlement background is a significant consider determining credit history, so guaranteeing that all expenses are paid in a timely manner can slowly enhance creditworthiness. Additionally, keeping charge card balances reduced family member to the credit line can favorably influence credit history. secured credit card singapore. Experts recommend keeping credit scores usage below 30% to show liable credit scores administration.

One more approach for building credit report sensibly is to monitor credit report records routinely. By evaluating credit score records for mistakes or indicators of identification burglary, people can resolve issues quickly and preserve the accuracy of their credit score background.

Gaining Long-Term Conveniences

Having actually established a foundation of liable credit rating monitoring post-bankruptcy, people can now concentrate on leveraging their boosted credit reliability for long-lasting financial advantages. By continually making on-time repayments, keeping credit history usage low, and checking their credit report reports for precision, former bankrupts can gradually reconstruct their credit report. As their credit report enhance, they may end up being eligible for far better charge card provides with reduced rates of interest and higher Check Out Your URL credit line.

Enjoying long-term advantages from enhanced creditworthiness prolongs past just bank card. It opens up doors to favorable terms on financings, mortgages, and insurance policy costs. With a solid debt background, individuals can discuss better rates of interest on lendings, possibly conserving thousands of bucks in passion payments gradually. In addition, a positive credit score account can enhance task potential customers, as some companies may inspect credit reports as part of the helpful hints employing procedure.

Final Thought

To conclude, previous bankrupt individuals may have problem securing bank card following discharge, however there are alternatives readily available to help reconstruct credit report. Recognizing the different kinds of charge card, aspects impacting authorization, and the importance of accountable bank card use can aid individuals in this scenario. By choosing the best card and using it properly, former bankrupts can slowly enhance their credit rating and gain the lasting advantages of having accessibility to debt.

Showing responsible financial behavior post-bankruptcy, such as paying bills on time and maintaining credit rating utilization reduced, can additionally favorably influence credit report card approval. Additionally, keeping credit rating card equilibriums reduced loved you can try these out one to the credit score limitation can positively impact credit ratings. By constantly making on-time repayments, keeping credit application low, and monitoring their credit records for accuracy, former bankrupts can progressively reconstruct their credit rating ratings. As their credit score scores raise, they may come to be qualified for better debt card uses with lower passion rates and greater credit report limits.

Recognizing the different kinds of credit rating cards, variables impacting authorization, and the importance of accountable credit scores card use can help individuals in this situation. secured credit card singapore.